2024 Business Tax Calendar: Don’t Miss the Party!

Dear Business Owners, as you navigate the seas of entrepreneurship, mark these 2024 tax dates on your captain’s log. Each deadline is a checkpoint in your voyage to success, sprinkled with a bit of humor because, let’s face it, taxes can be a bit dry.

1. January 31, 2024 The W-2 and 1099 Mingle

By this date, make sure all W-2s and 1099s have been sent out to your crew. It’s like sending out invites to the year’s biggest party – nobody wants to be forgotten!

2. March 15, 2024 S-Corp and Partnership RSVP

For S-Corporations and Partnerships, your Form 1120S or 1065 is due. Think of it as your business saying, “Yes, we’ll be attending the tax party, and here’s what we’re bringing to the table.”

3. April 16, 2024 The Main Event for Corporations

Corporations, it’s your turn to shine with Form 1120. This date is your solo performance on the tax stage – make it count!

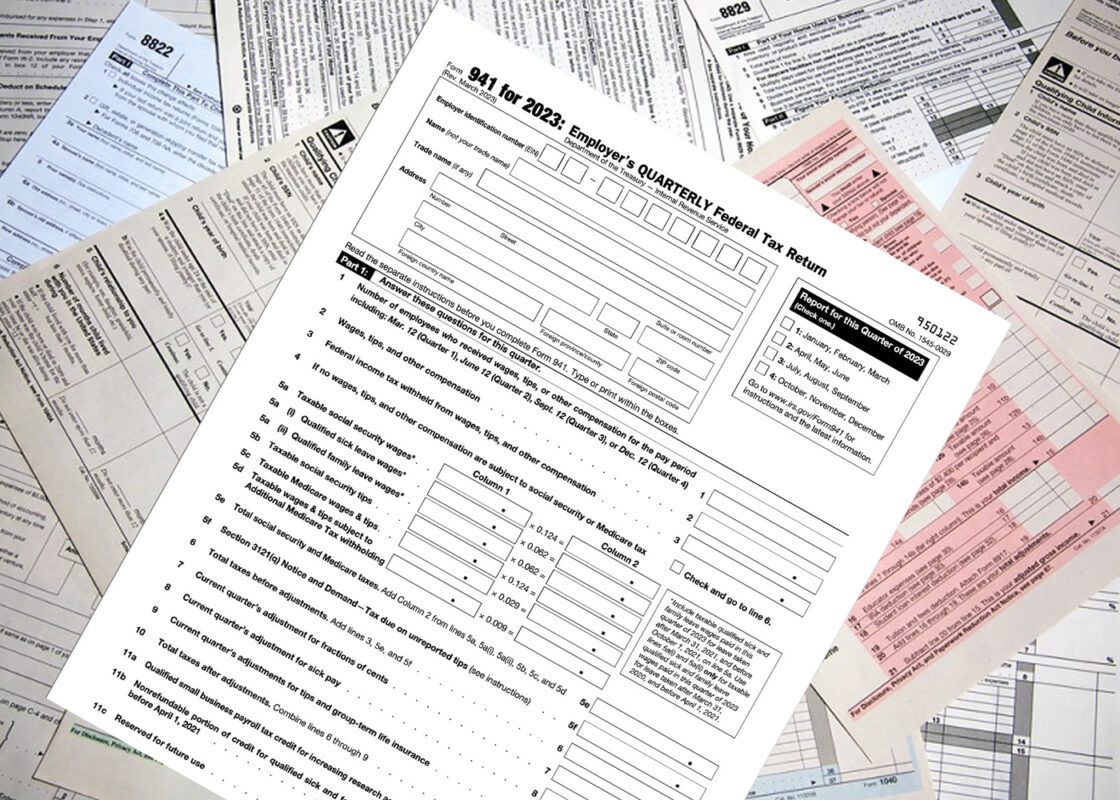

4. April 16, 2024, June 15, 2024, September 16, 2024, and January 15, 2025

The Quarterly Gatherings

These are your quarterly estimated tax payment dates. Imagine them as seasonal get-togethers where you keep the IRS updated on how your business is doing.

5. September 16, 2024 The Extension Celebration

If you filed for an extension, this is your finale. Wrap up your tax responsibilities with a flourish and look forward to the year ahead.

Let’s navigate these dates with precision and a touch of humor, ensuring our businesses not only comply with tax laws but also enjoy the journey. Remember, being timely with taxes is one way to keep your business sailing smoothly on the high seas of success!